Stay up to date on the latest federal and provincial budget changes and how they’ll affect your 2026 tax return. New federal tax brackets and rate adjustments • Budget measures impacting credits, benefits, and filing strategi• Provincial tax updates and planning considerations

Tax Seminar - ABIL & Stop loss rules by Manu Kakkar

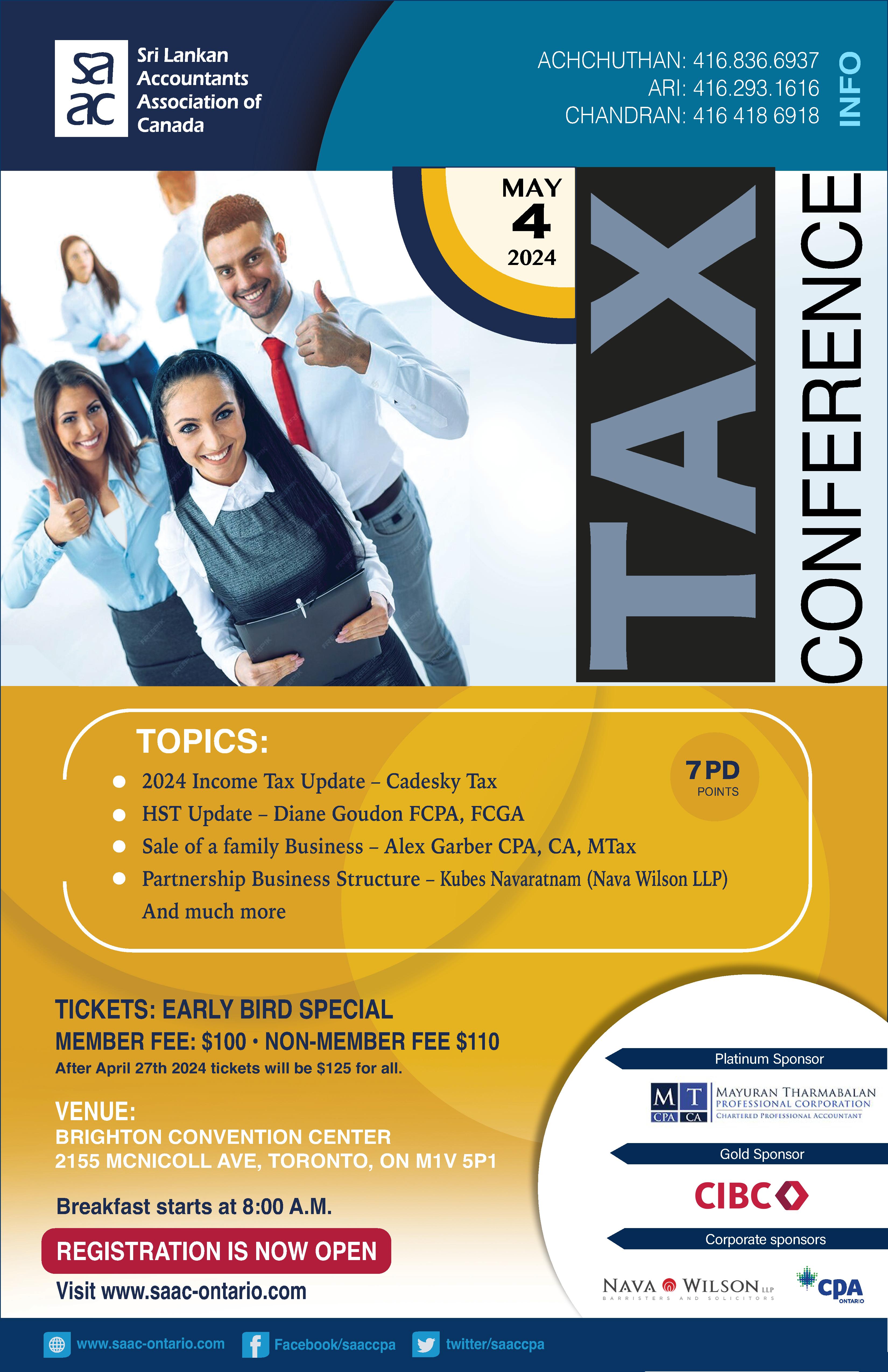

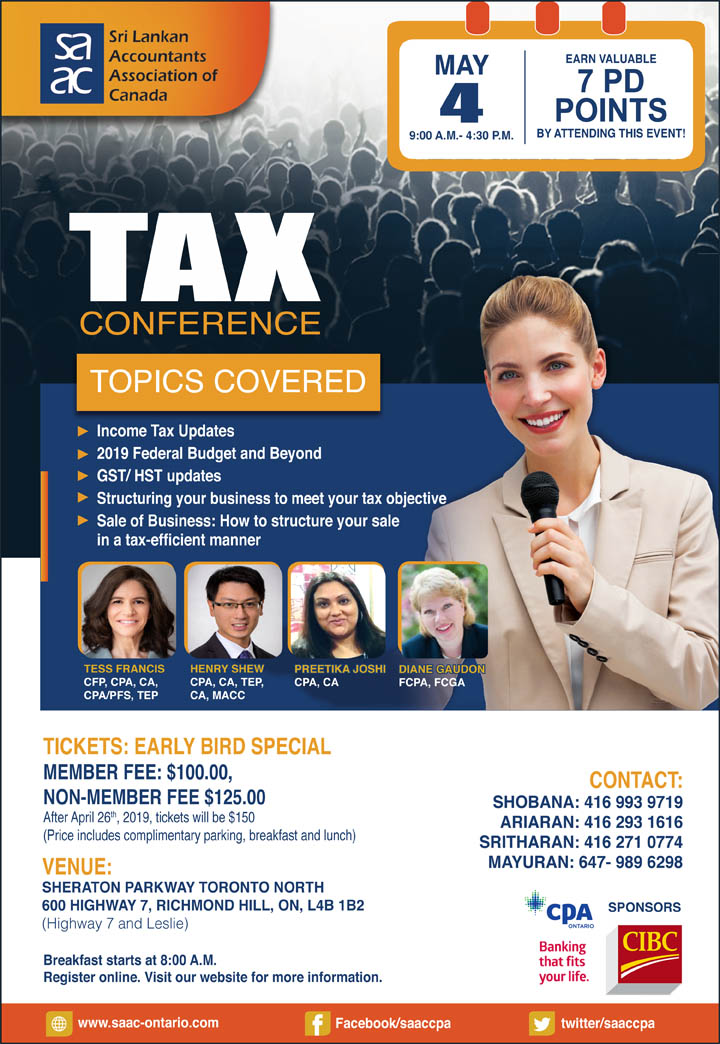

TAX CONFERENCE - EARN 7 PD POINTS

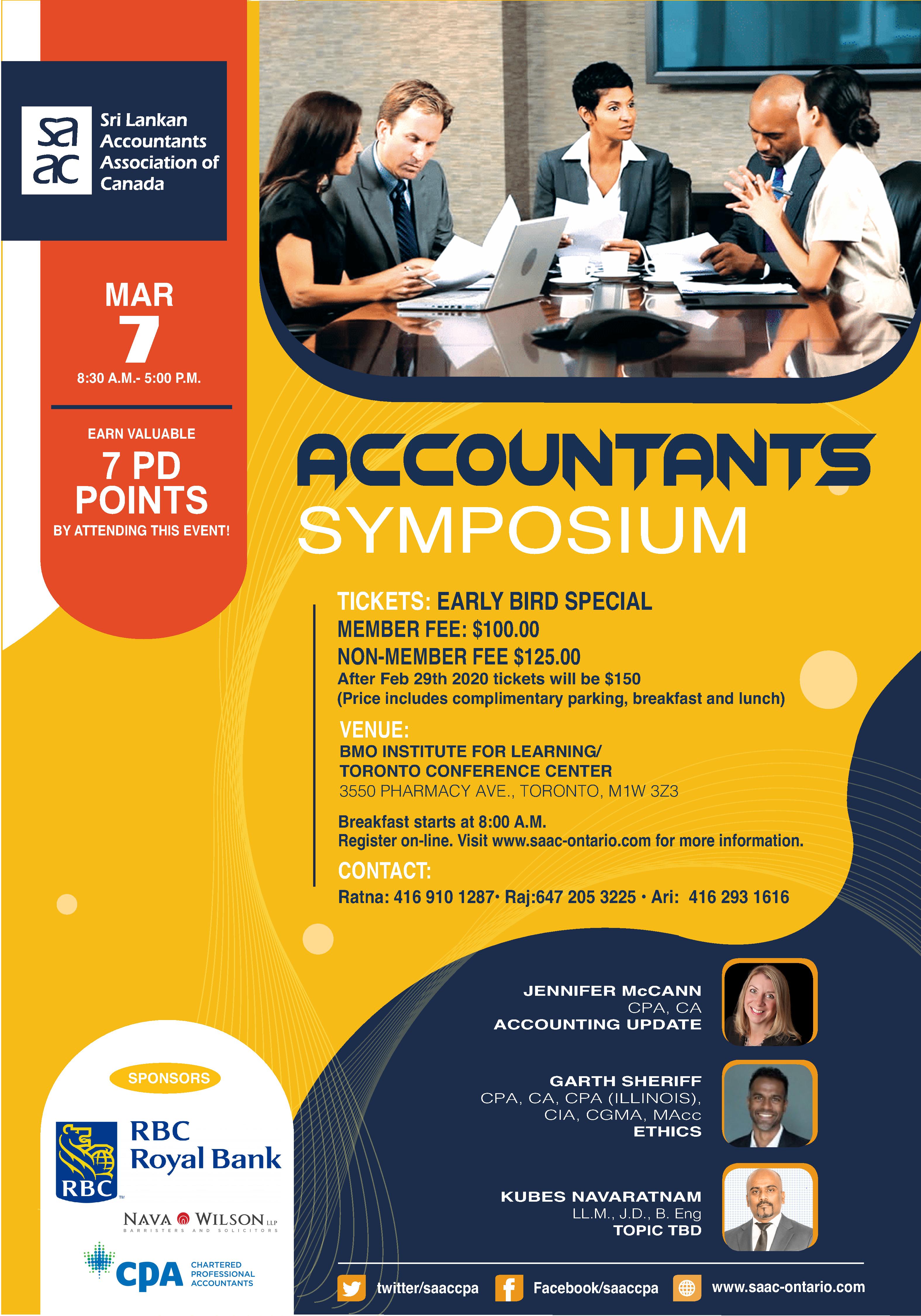

1. ACCOUNTING UPDATE 2. CPA CODE OF CONDUCT 3. AUDIT AND ASSURANCE UPDATE 4. KNOW YOUR LEGAL POINTS 5. ECONOMIC AND SHARE MARKET UPDATE 6. STRETCHING TIME

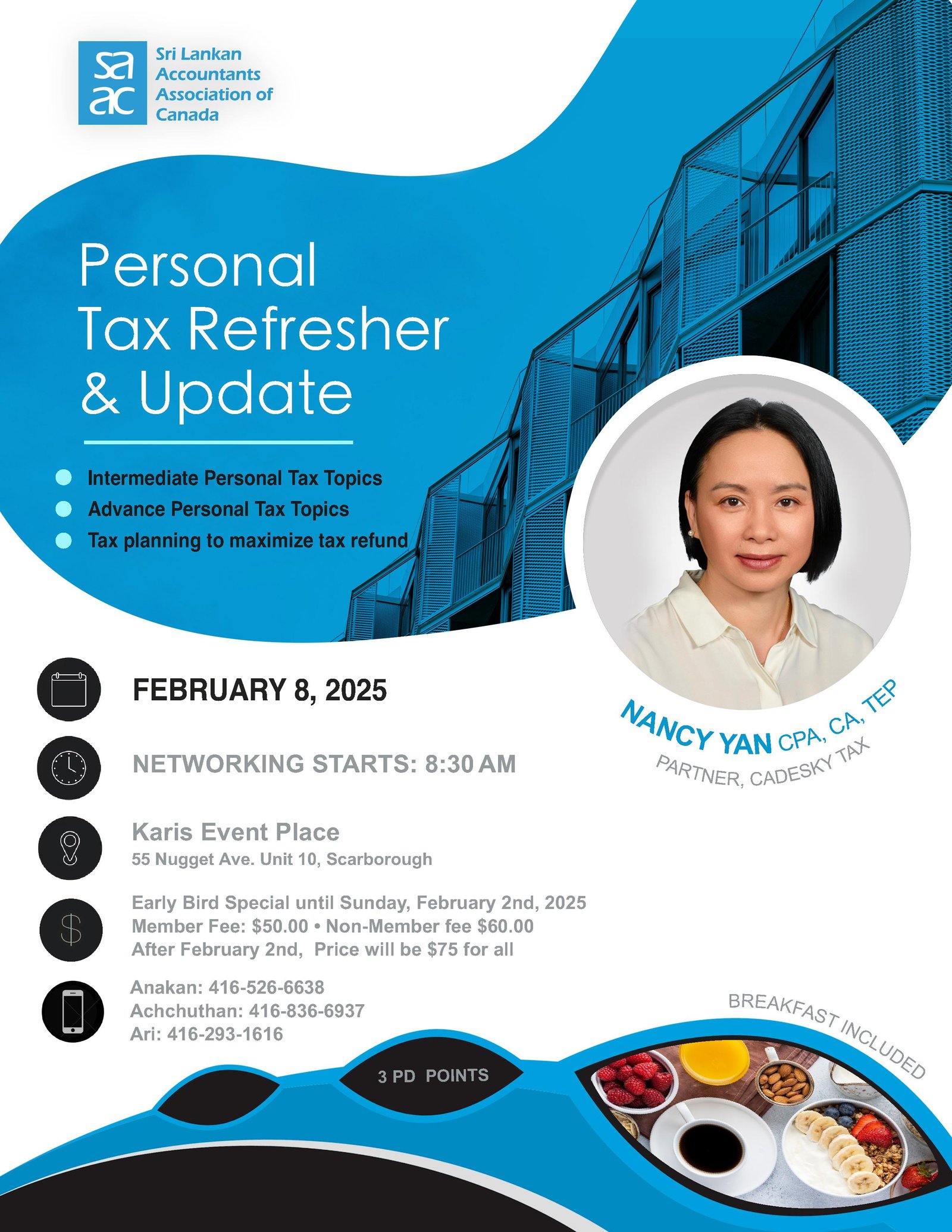

Intermediate and advance Personal Tax Updates

Enhance your tax preparation skills and gain insights from expert in Corporate tax by Marco Jotic, CPA, CGA, TEP

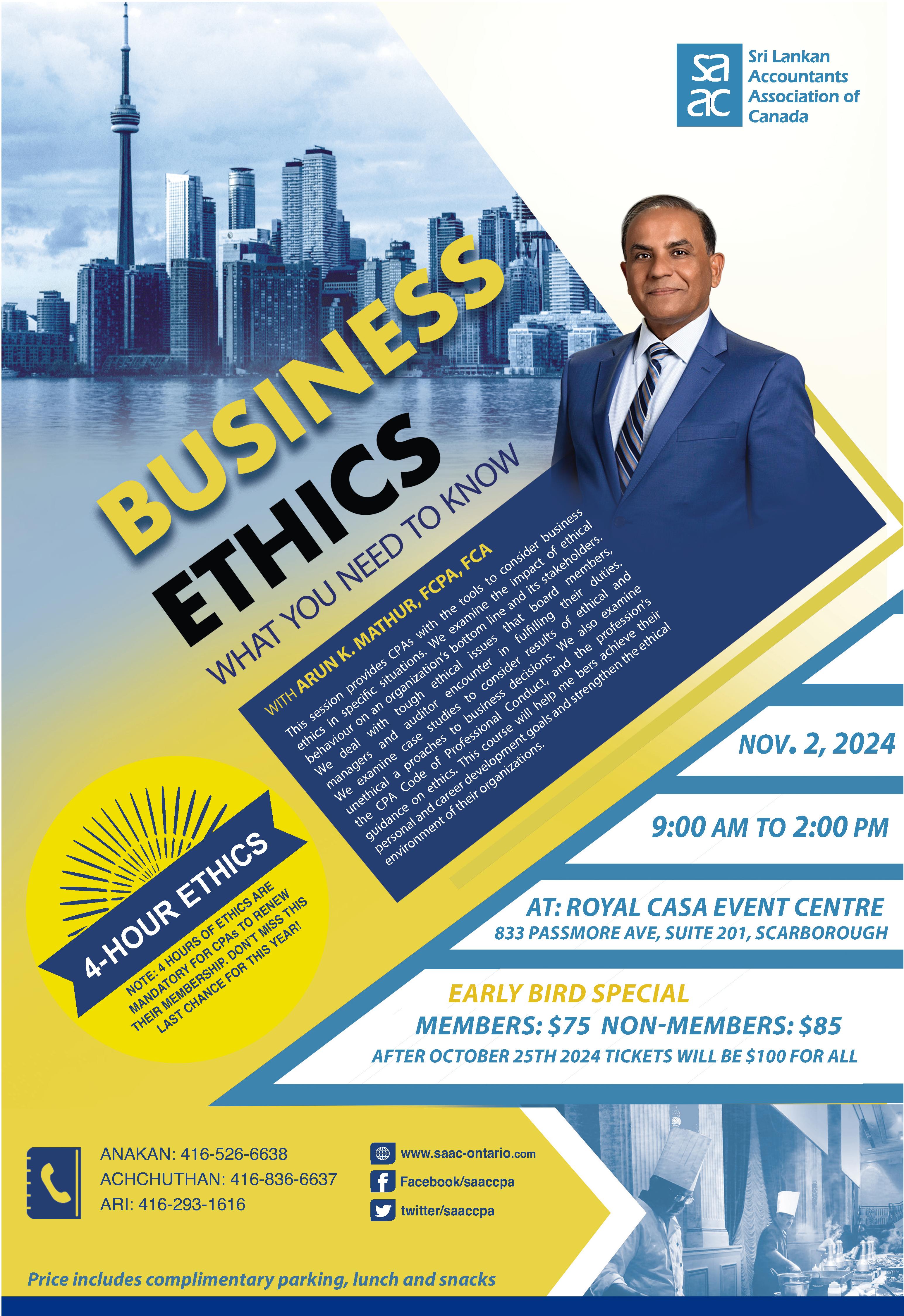

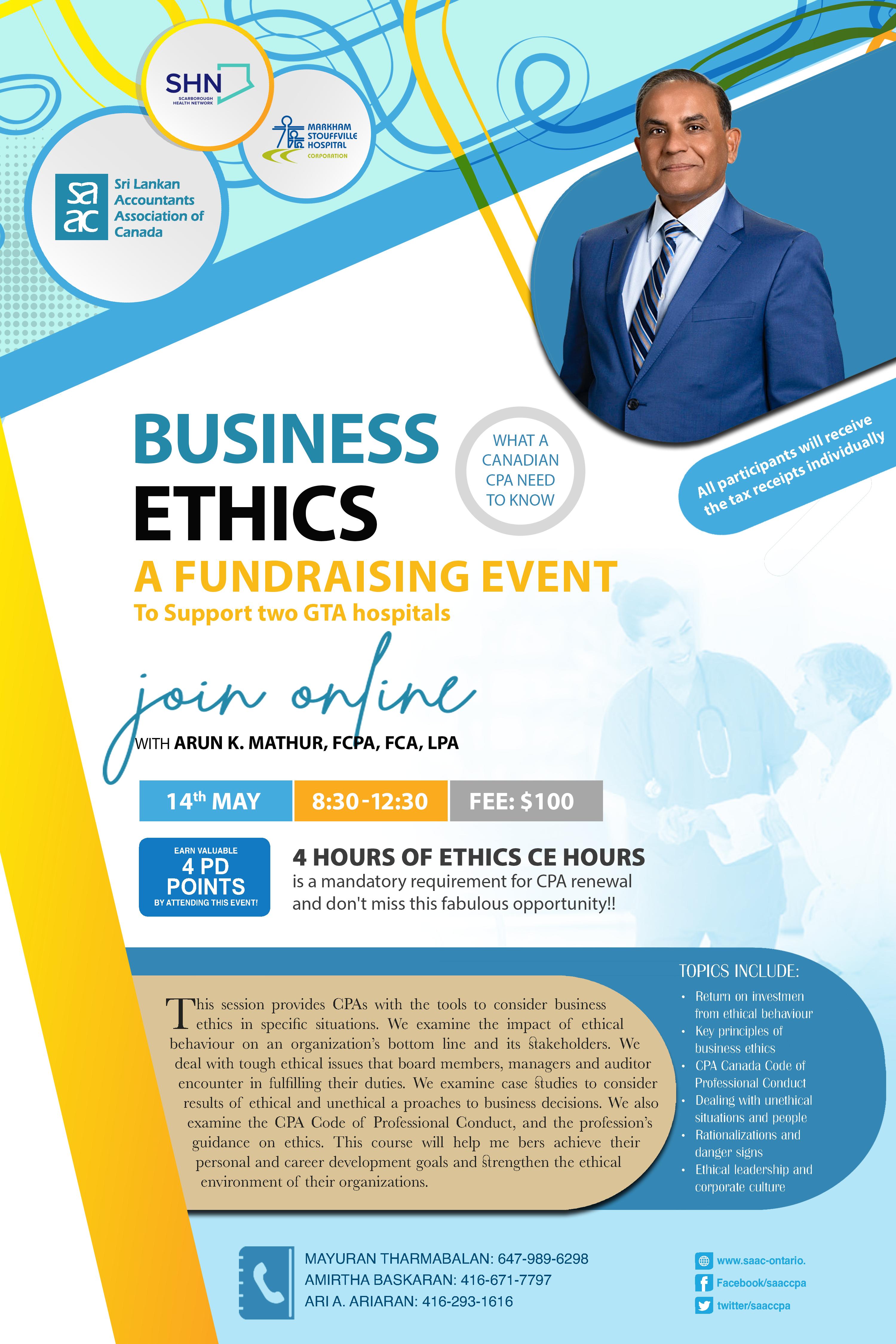

WHAT YOU NEED TO KNOW IN BUSINESS ETHICS - 4 HOUR COURSE BY ARUN . MATHUR, FCPA, FCA

Seminar 123

INCOME TAX, HST, SALE OF FAMILY BUSINESS & PARTNERSHIP BUSINESS STRUCTURE AND MUCH MORE

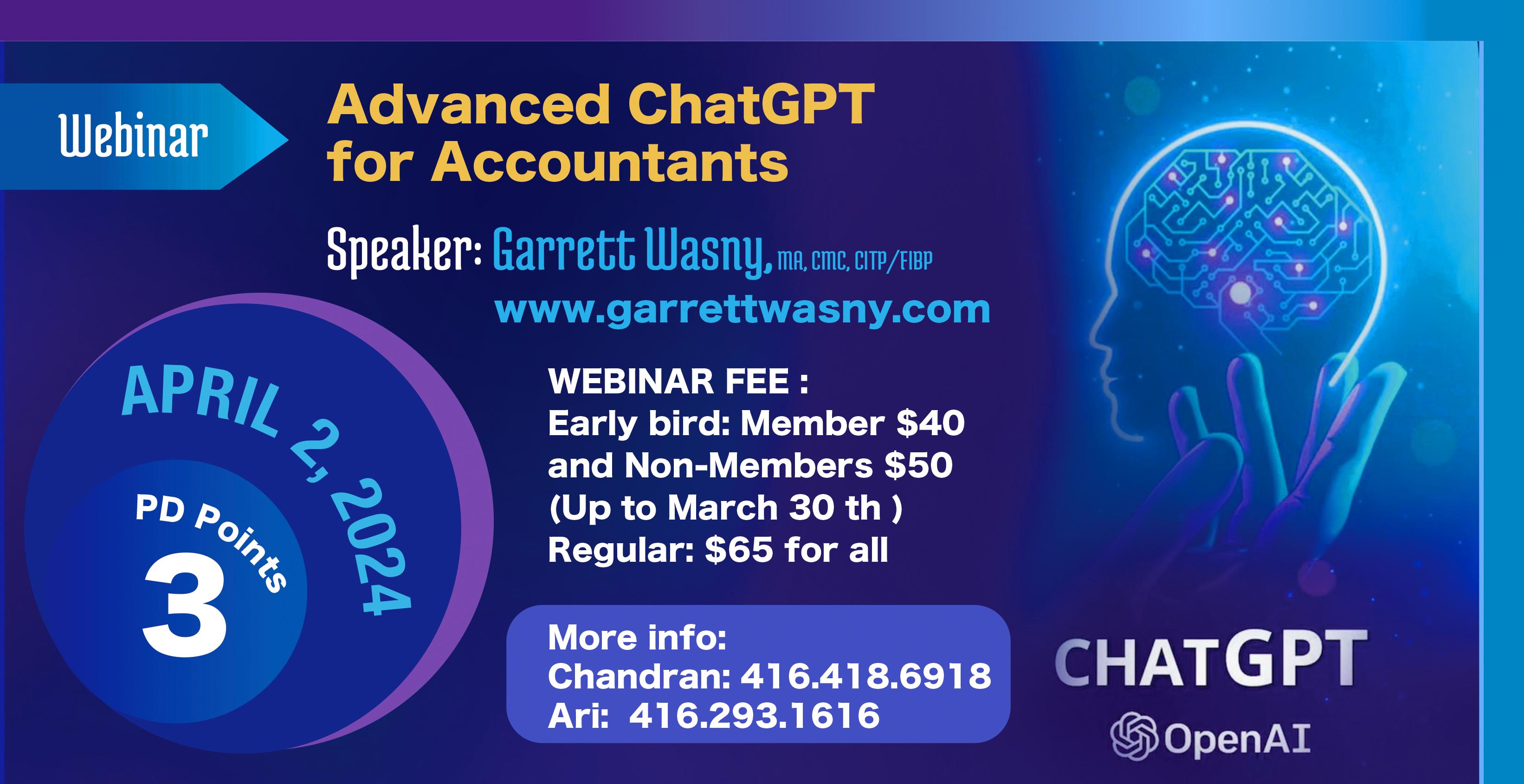

Advanced Chat GPT for Accountants by Garrett Wasny

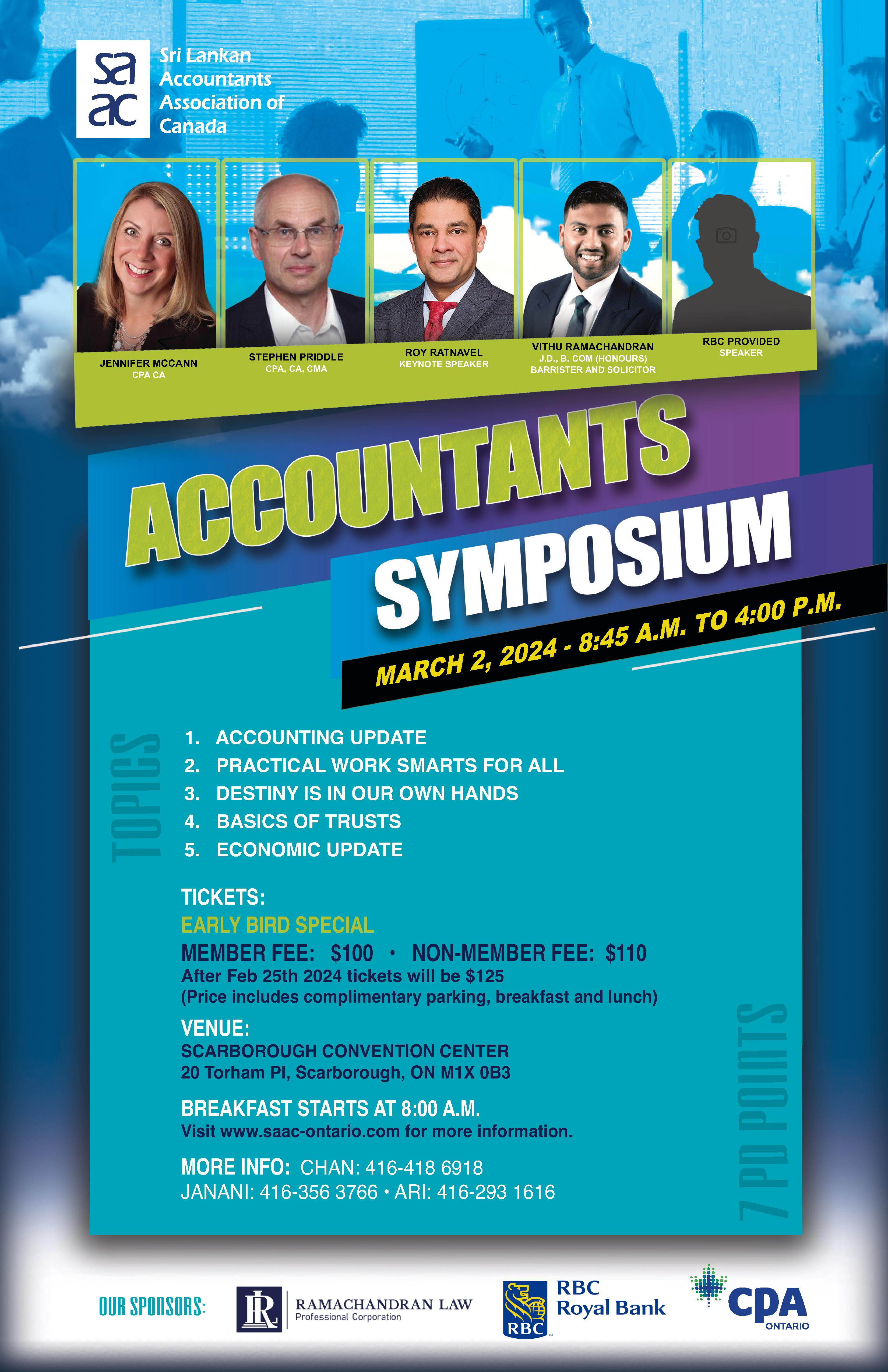

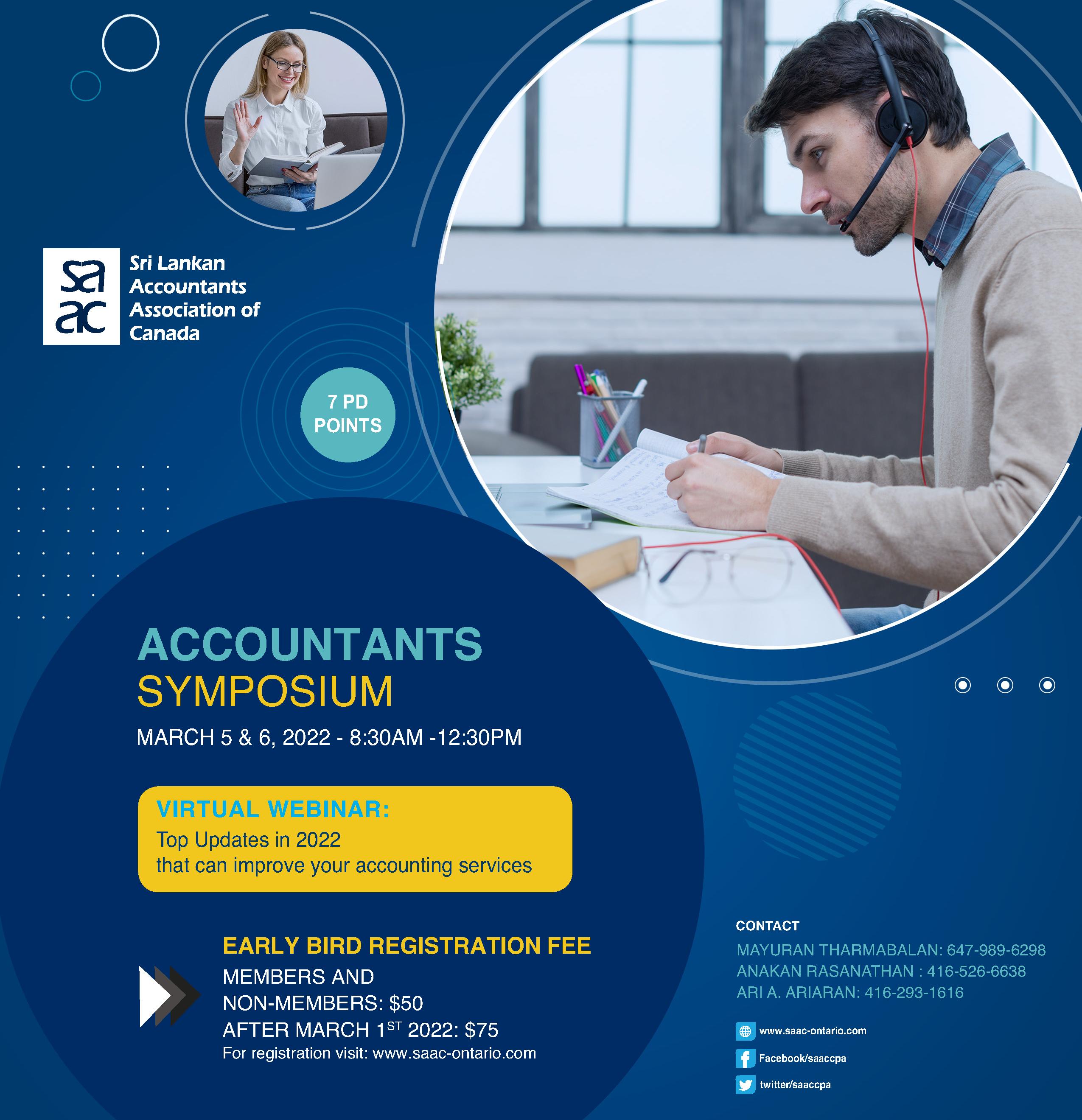

ACCOUNTANTS SYMPOSIUM 1. ACCOUNTING UPDATE 2. PRACTICAL WORK SMARTS FOR ALL 3. DESTINY IS IN OUR OWN HANDS 4. ESTATES/TRUSTS/BANKRUPTCY 5. ECONOMIC UPDATE

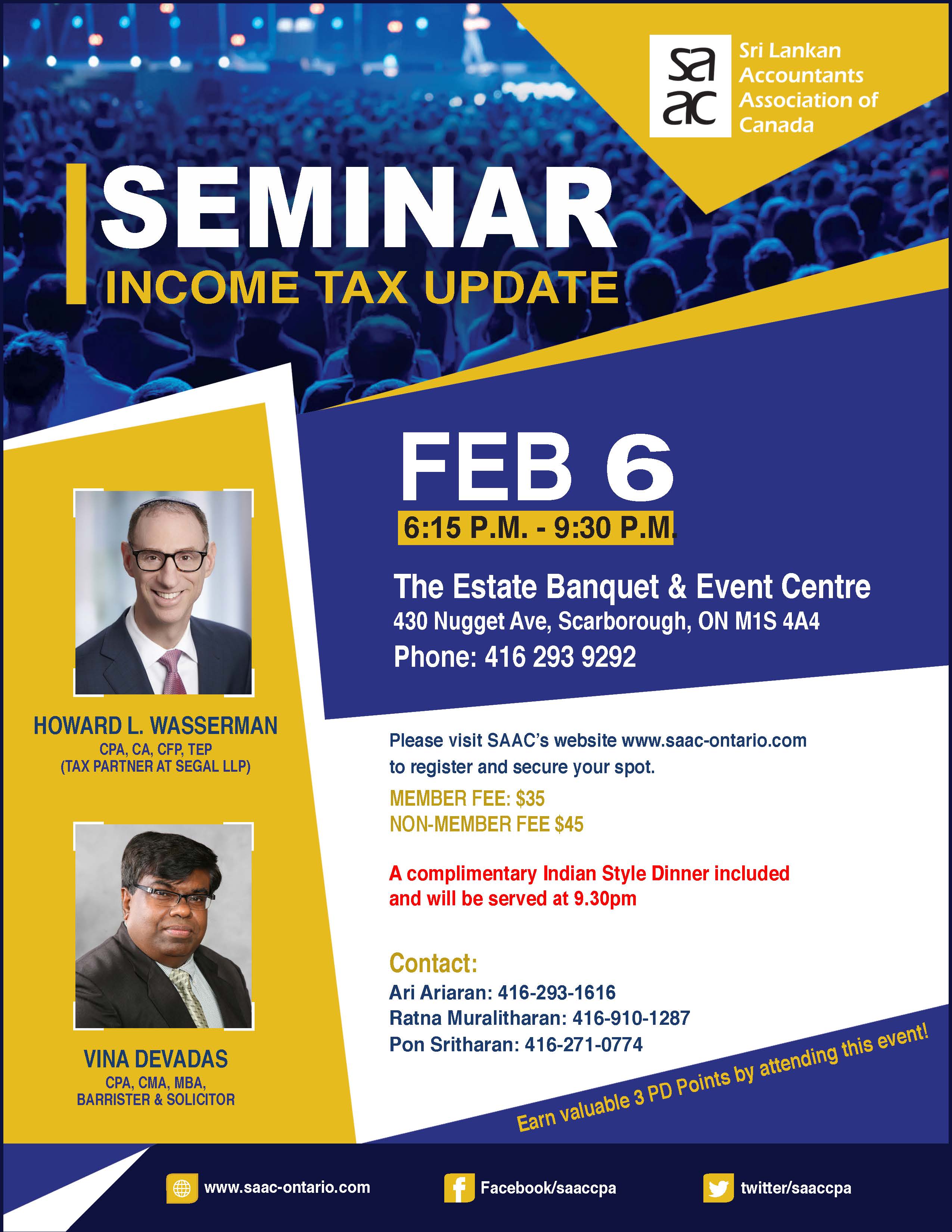

INCOME TAX UPDATE by HOWARD L. WASSERMAN

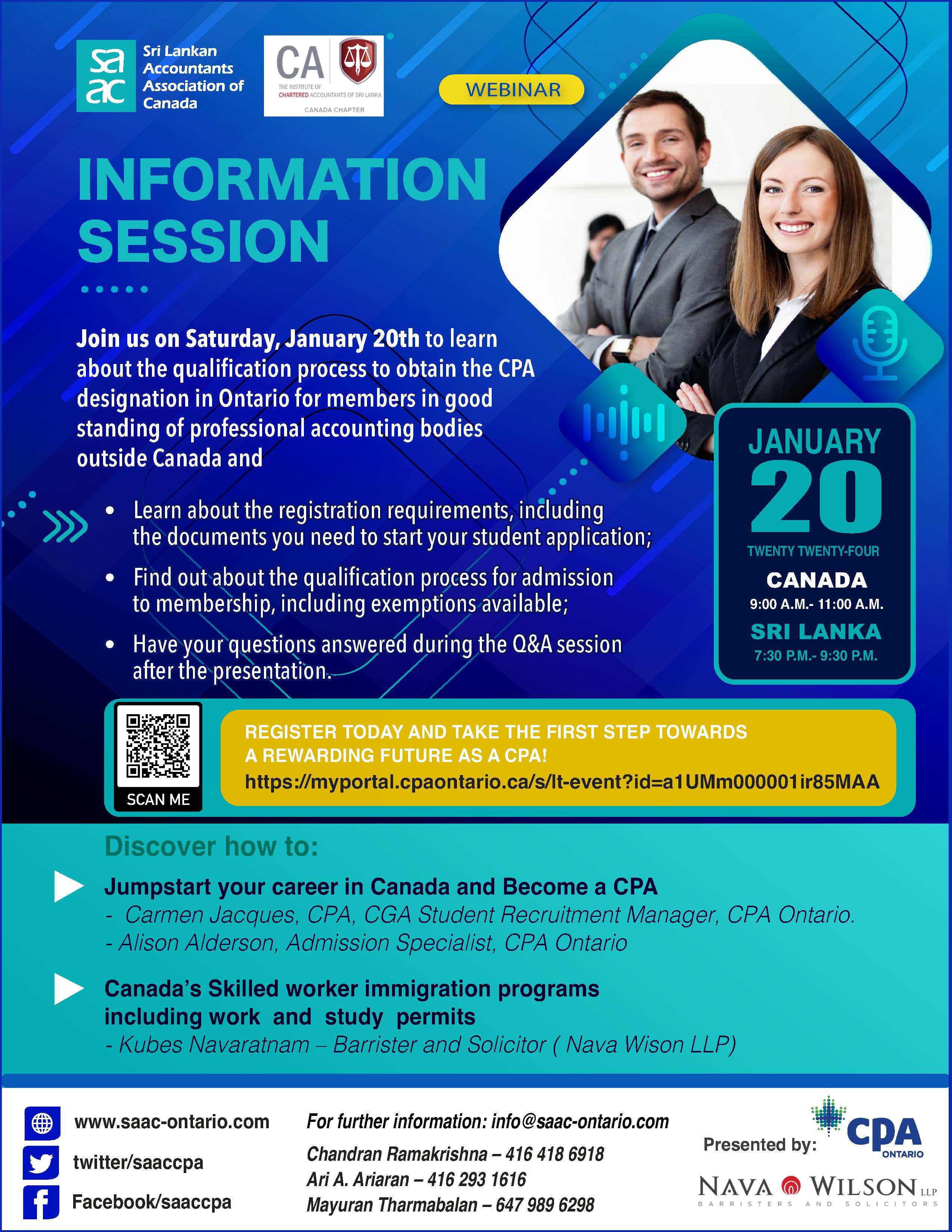

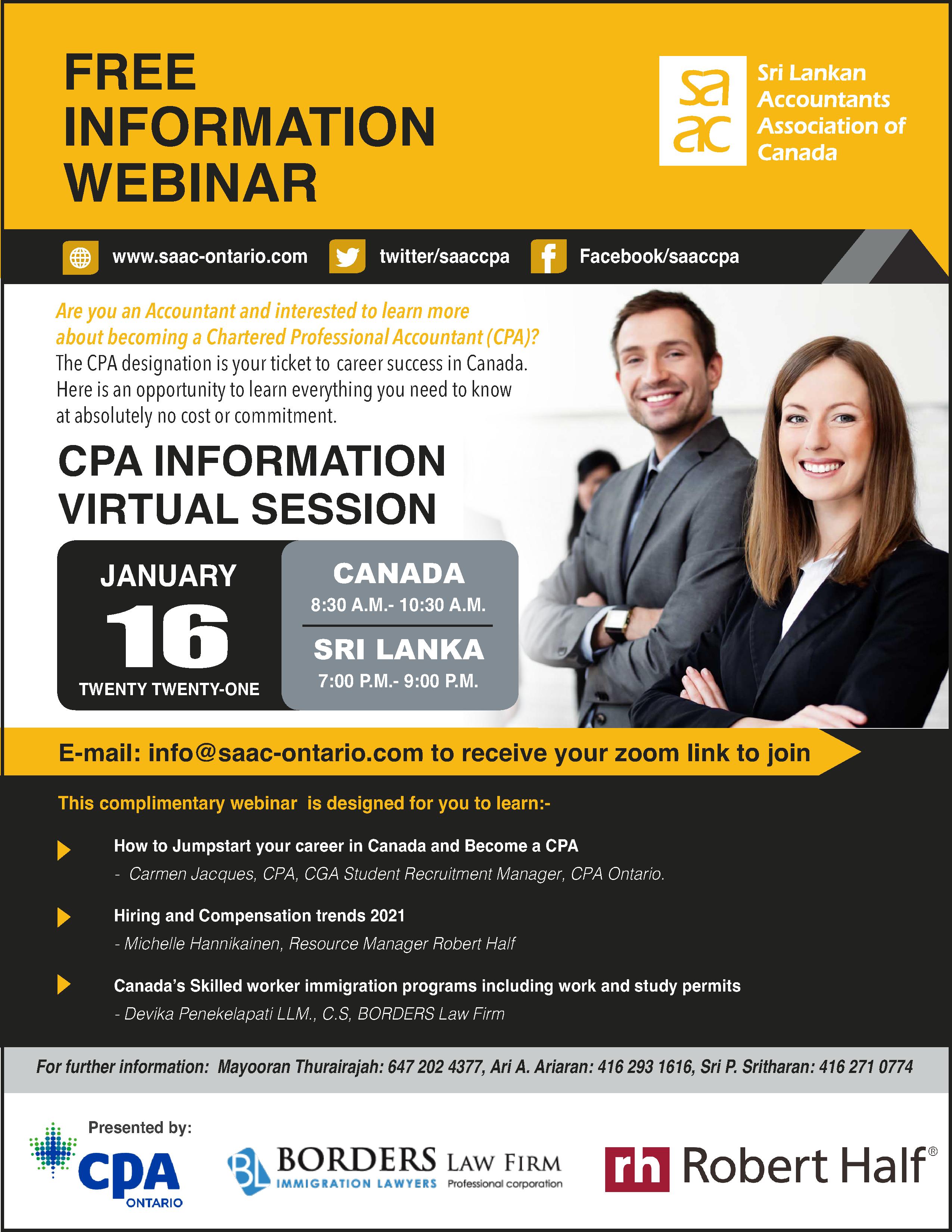

• How to Jumpstart your career in Canada and Become a CPA - Carmen Jacques, CPA, CGA Student Recruitment Manager, CPA Ontario. (45 Minutes) • Canada’s Skilled worker immigration programs including work and study permits – Kubes Navaratnam, Barrister & Solicitor.

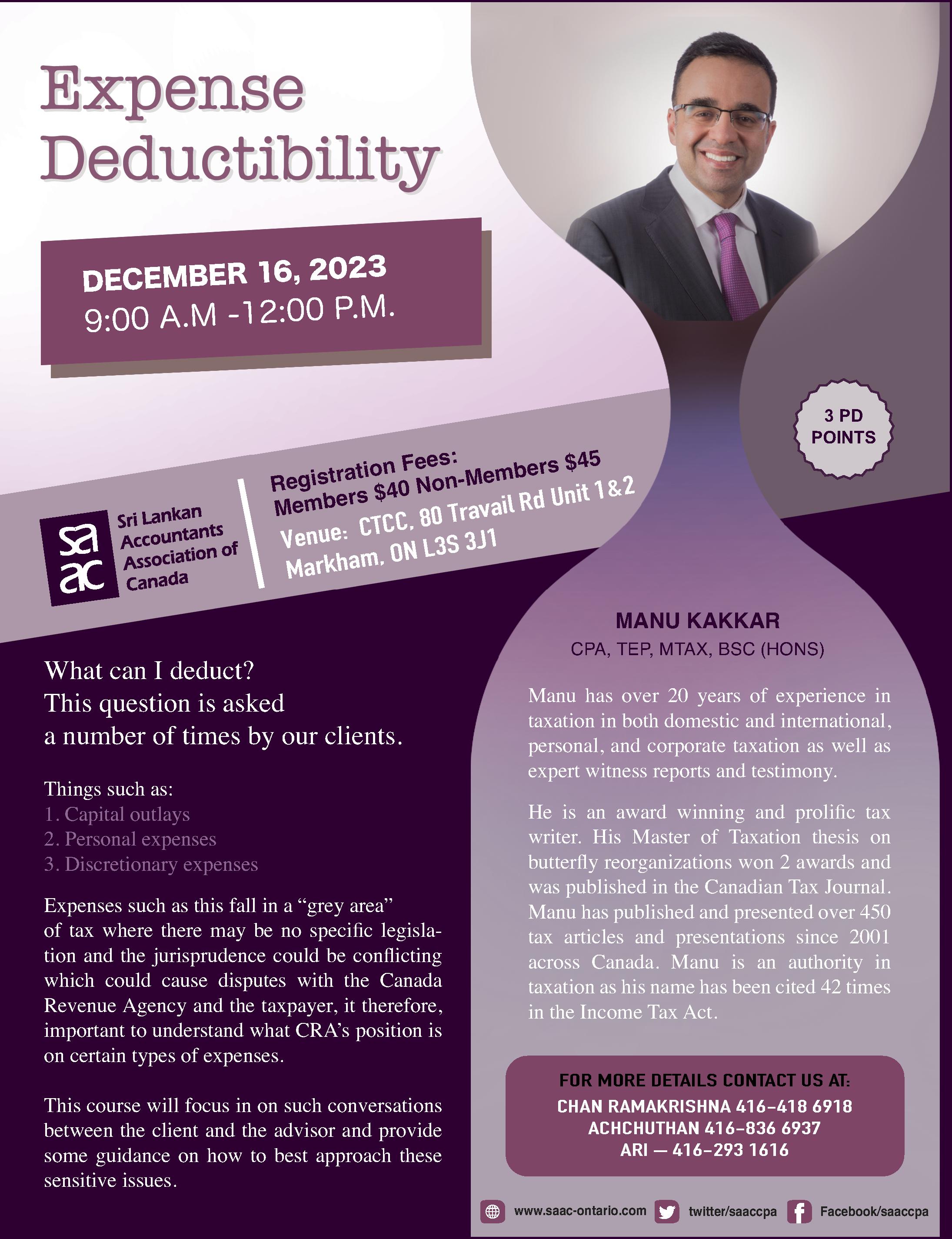

What can I deduct? This question is asked a number of times by our clients. Things such as: 1. Capital outlays 2. Personal expenses 3. Discretionary expenses

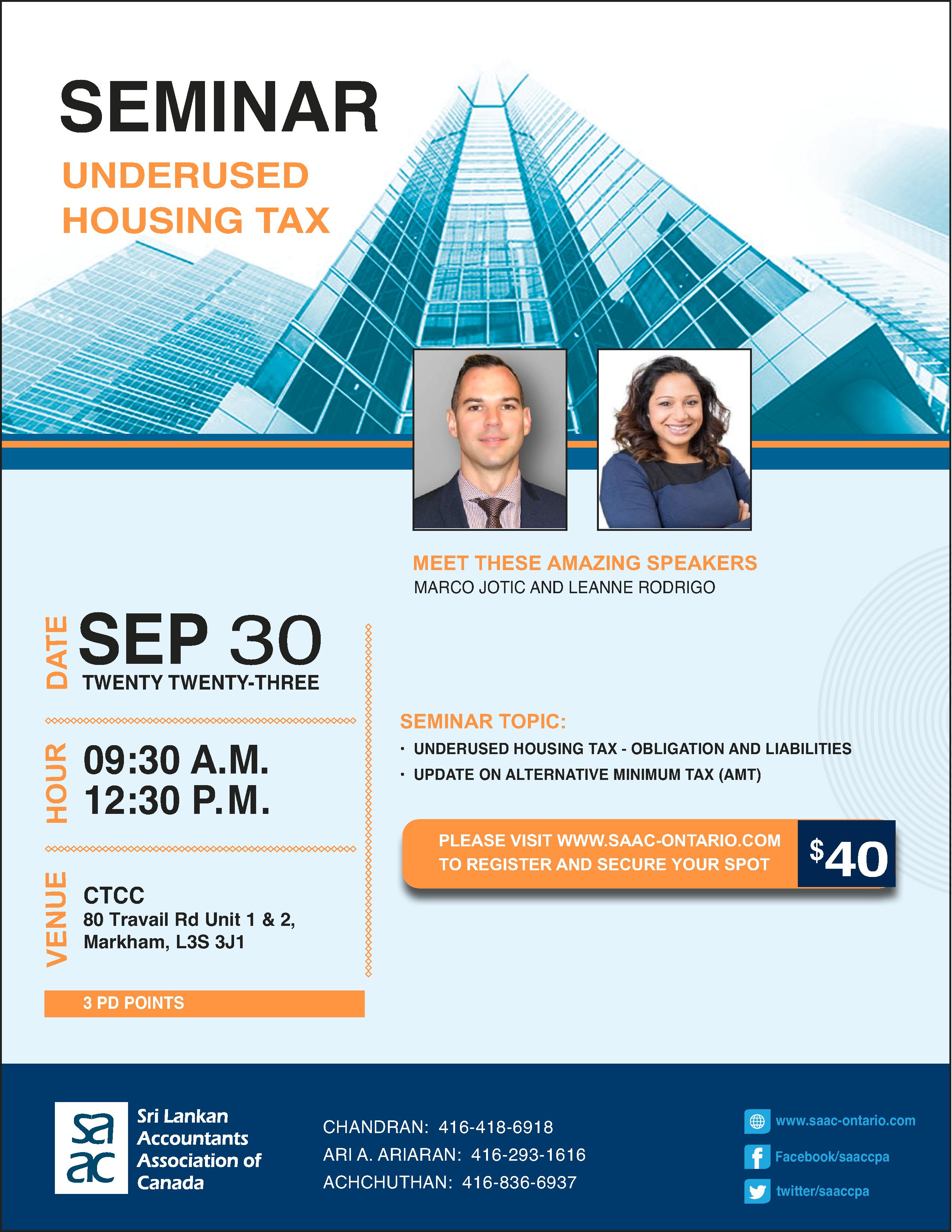

Underused Housing Tax - Obligation and liabilities

ACCOUNTANTS SYMPOSIUM - FULL DAY CONFERENCE WITH 7 PD POINTS, BREAKFAST AND LUNCH

PERSONAL TAX PREPAATION ISSUES TIPS & TRAPS

We would like to inform you that the Tax Update seminar has been rescheduled to February 22nd 6.00 pm

Are you an Accountant and interested to learn more about becoming a Chartered Professional Accountant (CPA)? The CPA designation is your ticket to career success in Canada. Here is an opportunity to learn everything you need to know at absolutely no cost or commitment. Register here: https://myportal.cpaontario.ca/s/lt-event?id=a1U5W0000000C4cUAE ____________________________________________________________________________ https://bit.ly/3X8Ganf

DIVORCE & ESTATE PLANNING

WRITING UNAMBIGUOUSLY ........

This session provides CPAs with the tools to consider business ethics in specific situations. We examine the impact of ethical behaviour on an organization’s bottom line and its stakeholders. We deal with tough ethical issues that board members, managers and auditors encounter in fulfilling their duties. We examine case studies to consider results of ethical and unethical approaches to business decisions. We also examine the CPA Code of Professional Conduct, and the profession’s guidance on ethics. This course will help members achieve their personal and career development goals and strengthen the ethical environment of their organizations.

ATEND THIS TWO DAYS ACCOUNTANTS SYMPOSIUM AND EARN 7 PD POINTS

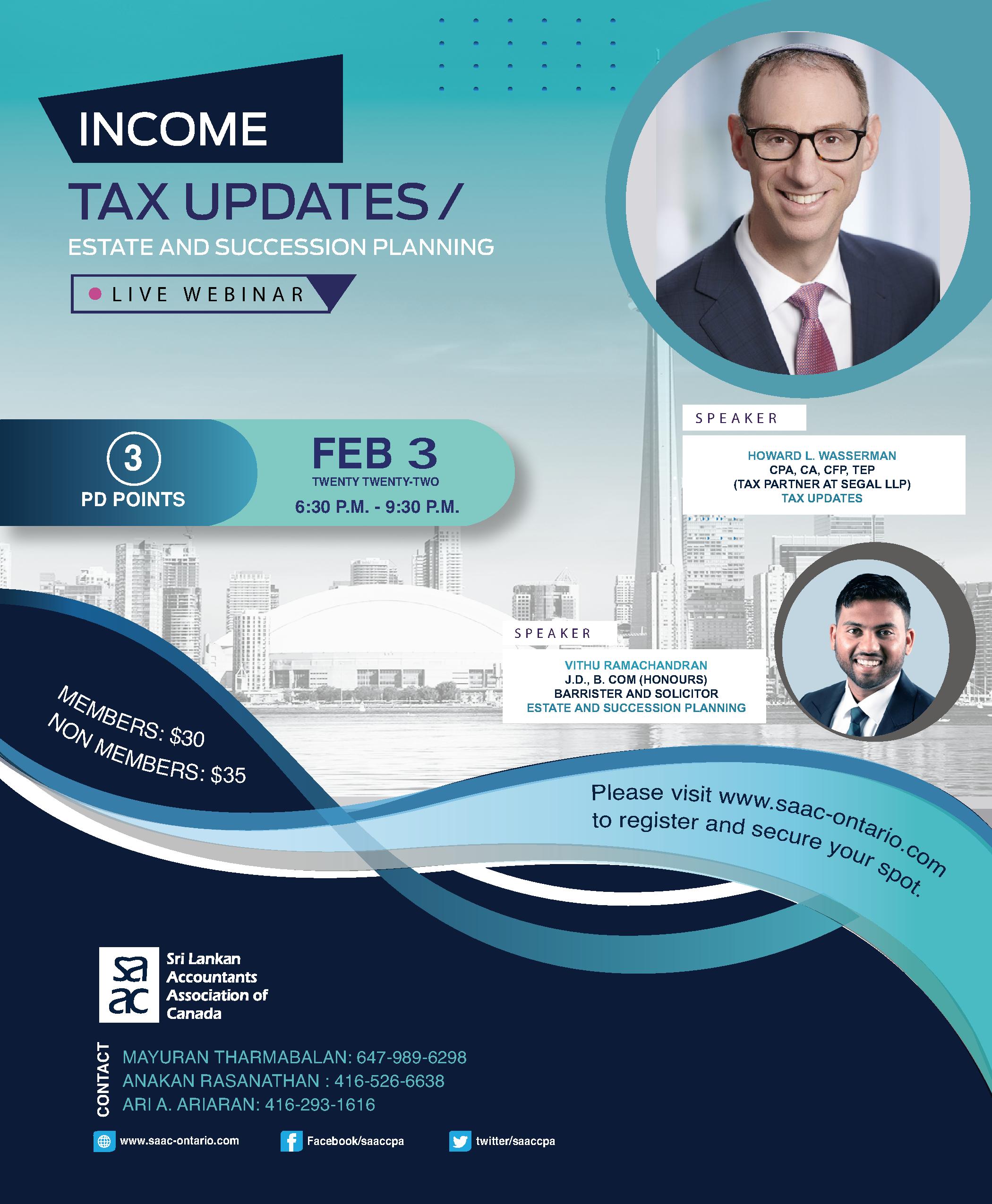

TAX UPDATES & ESTATE AND SUCCESSION PLANNING

Improving psychological safety Qualifies as ethics professional development credit) Garth Sheriff, CPA, CA, CPA (Illinois), CIA, CGMA, Member of ACTRA Saturday, November 27th, 2021 Between 9.00am to 11.00Noon

TAX CONFERENCE SATURDAY SEPT 18th 8.30 am to 1.00 pm SUNDAY SEPT 19th 9.00 am to 12.30pm

Accountants Symposium Saturday, March 6th, 2021 – 8.30am to 12.30pm Sunday, March 7th, 2021 – 8.30am to 12.30pm

Income tax update by Howard L. Wasserman

We are organizing a virtual information session for the benefit of the accountants and accounting students in Sri Lanka who are aspiring to migrate to Canada. This would enlighten them with all the detail information they need to start their process. The session consists of 3 presentations • How to Jumpstart your career in Canada and Become a CPA - Carmen Jacques, CPA, CGA Student Recruitment Manager, CPA Ontario. (45 Minutes) • Hiring and Compensation trends 2021 - Michelle Hannikainen, Resource Manager, Robert Half (30 Minutes) • Canada’s Skilled worker immigration programs including work and study permits - Devika Penekelapati LLM., C.S, BORDERS Law Firm (45 Minutes)

Practice Made Perfect sales practice program brings true change in behaviour, helping employees to achieve their sales goals with greater focus, confidence, and capacity. The program’s five modules cover the essential sales skills. The module on "Pitch Perfect" will teach you how to convey even the most complex ideas in a simple and persuasive way." Please note the seminar leader will be contacting you directly via email. The typical schedule for emailing participants is below. Prior to Event • 5 days - welcome email with general information & instructions & the link to the webinar • 1-2 days - reminder email with a variation of the above Post Event • 1-2 days - follow up email • 2-4 weeks - check-in email

Artificial intelligence: Are we handing over our professional judgement to AI? On Saturday, November 14, 2020 between 9.00 am - 11.00 pm By Garth Sheriff CPA, CA, CPA (Illinois), CIA, CGMA, MAcc. Zoom link will be provided upon registration.

GST/HST Presentation on Common Audit Exposure During COVID-19 On Saturday, October 17, 2020 between 9.00 am - 11.00 pm By Diane Gaudon, FCPA, FCGA. Property Tax Are you being assessed correctly? between 11.00 am - 11.30 am By Rob Moore Ede Senior Manager - Global Property Taxes at Magna International. Corporate Legal Matters By Vinthan Asokanathan Nava Wilson LLP

Tax Planning for Owner Manager Businesses By Alex Ghani CPA CA, CGA, CPA (Texas) (Partner at CPA Solutions LLP) and Stan Shadrin CPA CA (Partner at CPA Solutions LLP Saturday, September 26, 2020 Between 9:00 am – 11:00 am Zoom link will be provided upon registration. Limited space only available on our webinar platform

Canada Emergency Wage Subsidy (CEWS) will be covered by Manu Kakkar in detail on May 07 today

<h1 dir="auto"><span style="color: #000000; font-size: large;">Presenter: Manu Kakkar CPA, CA, BSc.(Hons), TEP, MTax</span></h1> <div dir="auto"> </div> <div dir="auto"><span style="color: #000000; font-size: large;">Sri Lankan Accountant Association of Canada Inviting you to a scheduled Zoom meeting.</span></div> <div dir="auto"><span style="color: #000000; font-size: large;"> </span></div> <div dir="auto"><span style="color: #000000; font-size: large;"><strong>Topic: </strong>COVID-19 TAX UPDATE WEBINAR</span></div> <div dir="auto"><span style="color: #ff0000;"><strong><span style="font-size: large;">Time: Apr 9, 2020, 06:00 PM Eastern Time (US and Canada)</span></strong></span></div> <div dir="auto"><span style="color: #000000; font-size: large;"> </span></div> <div dir="auto"><span style="color: #000000; font-size: large;">Join Zoom Meeting</span></div> <div dir="auto"><span style="background-color: #00ff00;"><a style="background-color: #00ff00;" href="https://zoom.us/j/466253031?pwd=L1A3NjdreTRsNGZUZU5KdVMyNTRMZz09" target="_blank" data-saferedirecturl="https://www.google.com/url?q=https://zoom.us/j/466253031?pwd%3DL1A3NjdreTRsNGZUZU5KdVMyNTRMZz09&source=gmail&ust=1586454463214000&usg=AFQjCNE1EGlkCbjfK2M8NqtDA0XUtyNMvQ"><span style="color: #000000; font-size: large;">https://zoom.us/j/466253031?<wbr />pwd=<wbr />L1A3NjdreTRsNGZUZU5KdVMyNTRMZz<wbr />09</span></a></span></div> <div dir="auto"><span style="color: #000000; font-size: large;"> </span></div> <div dir="auto"><span style="background-color: #ffffff; color: #ff0000;"><strong><span style="font-size: large;">Meeting ID: 466 253 031</span></strong></span></div> <div dir="auto"><span style="background-color: #ffffff; color: #ff0000;"><strong><span style="font-size: large;">Password: 031408</span></strong></span></div>

ATTEND THIS ANNUAL SYMPOSIUM AND EARN 7 PD POINTS

Income Tax Update - By Howard L. Wasserman, CPA, CA, CFP, TEP (Tax Partner at Segal LLP) -------------------------------------------------------------------------------------------------------- Lease Back Agreements and its unintended GST/HST consequences - By Vina Devadas, CPA, CMA, MBA, Barrister & Solicitor

Another full day FINANCE CONFERENCE organised by SAAC

TAX CONFERENCE Income Tax Updates GST/ HST updates Structuring your business to meet your tax objective Sale of Business: How to structure your sale in a tax-efficient manner SHERATON PARKWAY TORONTO NORTH

Sri Lankan Accountants Association of Canada Proudly presents a seminar on Income Tax Update By Nancy Yan MBA, CPA, CA (Tax Partner at Cadesky & Associates LLP)

The symposium is meant to bring together practitioners, policy makers and academics in an atmosphere that encourages positive discourse on key areas for Accountants. Refund policy: No refund will be provided for cancellation 10 business days prior to the event (even if the tickets are purchased within the 10 business days prior to the event). We are pleased to provide refunds requested before 10 business day prior to the event. There will be an administration fee for the refund.